Table of Content

If you need to make a claim, you might find it faster to log this online at churchill.com/claims. Personal Possessions cover – cover items outside the home such as mobiles, tablets, laptops and jewellery. Yes they do, you can choose to add the below to any Home Insurance policy; . If you have a smaller claim, Churchill may be able to deal with your claim over the phone through their approved suppliers. You may need to provide them with estimates or quotations to support your claim. For larger claims, Churchill will most likely arrange for a Claims Advisor to come and visit you as soon as possible.

For an extra cost you can add legal protection for you and your family of up to £100,000. This includes cover for things like personal injury and clinical negligence, employment disputes, motoring prosecutions, and inheritance disputes. Thank you for spending a few minutes to visit our website today.

Churchill home insurance

Churchill Home Insurance has rebranded and introduced a new mascot to make the brand more appealing to a modern audience. Instead of using a bopping head like the previous company, the insurer has created an animated bulldog mascot. The CGI bulldog, known as “Chur-chill,” skateboards down a busy street while a narrator asks the dog questions. The new Churchie was created by Untold Studios, which worked on Netflix’s hit series The Crown. Family Legal Protection – get up to £100,000 to help with legal costs in the event of any disputes.

It's still important to compare different home insurance providers to make sure you're getting the right policy that covers your home insurance needs. You can pay extra for accidental damage which covers any accidents to your home or belongings. Accidental damage cover for buildings protects you if something happens such as a hammering through floorboards into a water pipe. Bikes worth more than £500, or other items worth more than £2,000 need to be listed on the policy.

Take a look at our optional extras

Therefore, whatever kind of policy you’re looking for you should be able to find the cover you’re after with Churchill. It was acquired by the Royal Bank of Scotland in 2003 but since 2021 it has been a part of the Direct Line Group, which is listed on the London Stock Market. The mascot for Churchill was the loveable nodding-dog ‘Churchie’ until last year and it’s one of the most recognisable British brands in the country. Be covered for emergencies such as a central heating breakdown or a broken front-door lock (up to £500 per call-out). Churchill was once again redesigned in October 2019, where his long serving nodding dog design was changed, to a new, CGI version. In recent years, talking soft toys have been added to the range of Churchill merchandise, and the character has a page on social networking site Facebook.

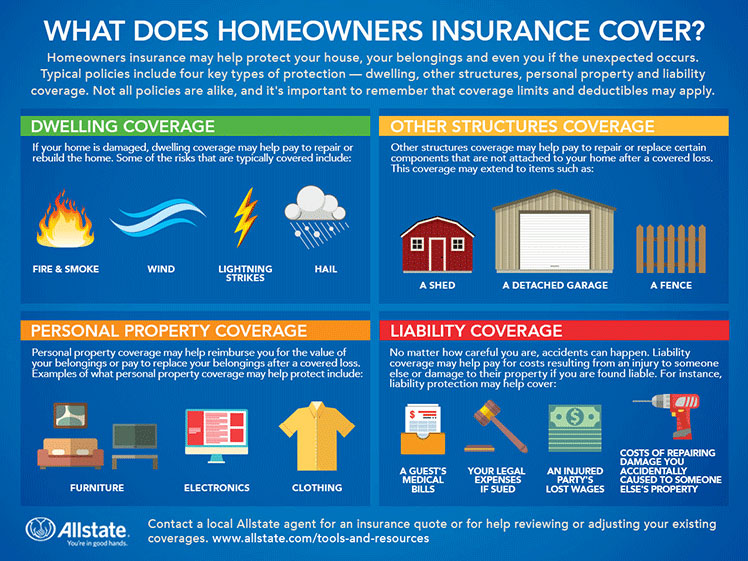

Churchill Home Insurance also provides help in tracing and determining the source of water leaks. You should always compare the cost of your car insurance to other policies. However, it is important to remember that it will depend on your situation, so never buy a policy without comparing the quotes and terms. The Churchill Buildings cover protects your home against damage caused by calamities such as storms, floods, and attempted theft. It also protects against damage caused by falling trees and subsidence.

About Churchill home insurance

Churchill life insurance policyholders receive 24/7 access to a GP, and their payments are fixed. They also have the option of adding additional benefits like critical illness cover. These plans can save you hundreds of dollars and are a good investment for your family.

If you have a claim-free history in the last three years, this will have a bearing on the premium price. There are a number of other factors which will influence the price you pay. This includes things such as your age and address, and the age and condition of your home.

The Churchill Insurance Agency provides local, friendly, and personalized service to address all of your insurance needs. We offer a variety of insurance products that will cover your life, home, car, farm, and business from Auto-Owners Insurance and Pioneer State Mutual Insurance Company. Churchill Home Insurance also includes emergency home repair cover.

Customers can read reviews to see what other people think about Churchill. Reviews are often a good way to find a good insurance company. You can also look at the company’s social media feeds to get an idea of its company culture.

Churchill offers two types of accidental damage cover that you can add to your home insurance policy for an additional premium. It has been selling home insurance policies since 1990 and it also sells a wide range of general insurance products. This critical illness plan can help you secure savings if you contract certain illnesses. It covers a range of conditions, including heart disease, stroke, and certain types of cancer.

Churchill offers two levels of cover to choose from; their standard cover, Home Insurance and their higher limits offer, Home Plus. Accidental damage cover for contents –This covers mishaps such as spilling paint on the carpet or accidentally dropping and breaking a TV. Accidental damage covercan be added to your Churchill Home Insurance policy.

No comments:

Post a Comment